Basic knowledges of two countries’ labor law

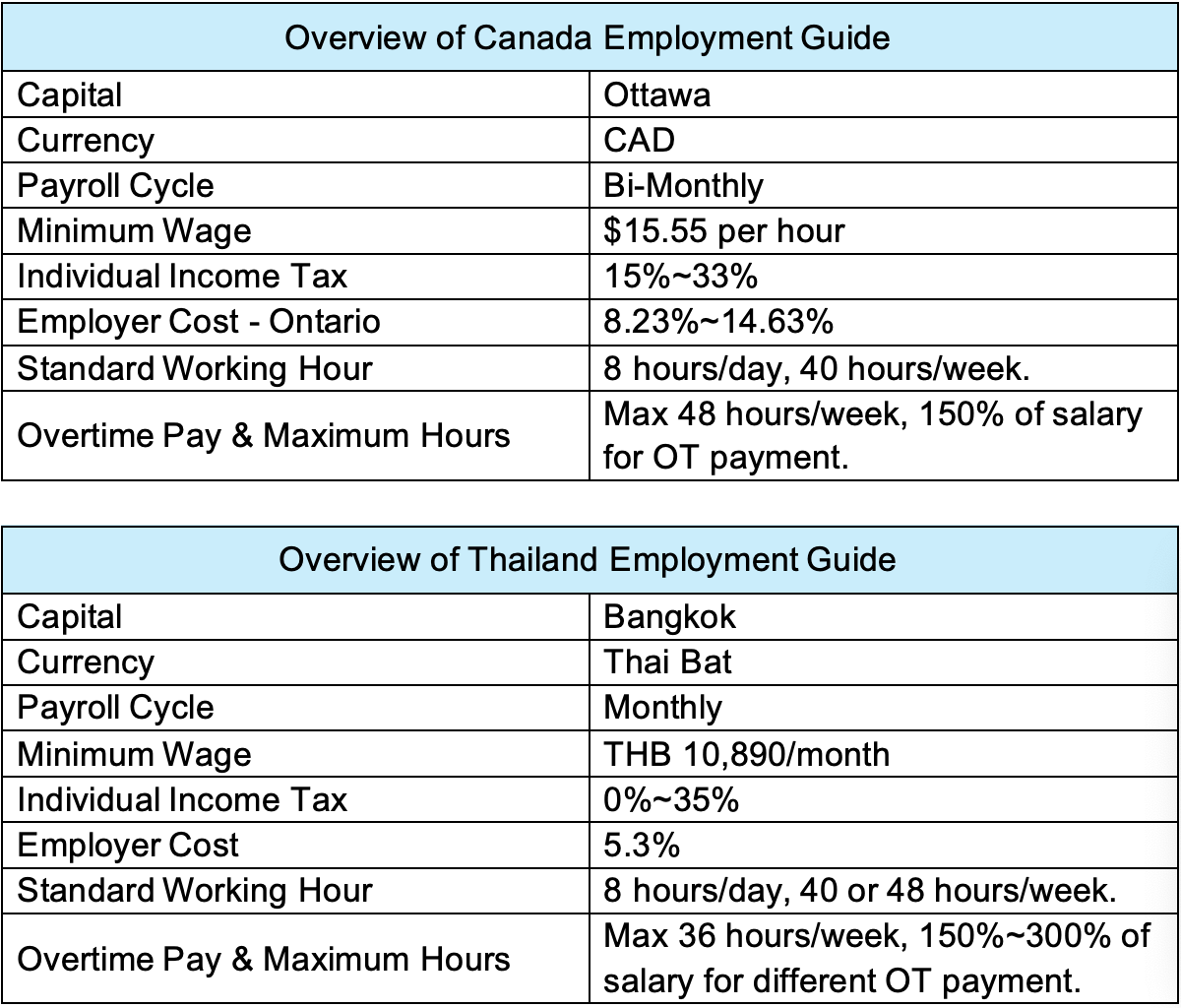

In today’s global marketplace, the successful management of international employment practices is a testament to a company’s operational excellence. For Canadian companies extending their reach into Thailand, this necessitates a nuanced understanding of the labor laws, cultural expectations, and financial services that shape the employee experience. Our comprehensive guide serves as a crucial resource, providing a clear overview of the employment landscapes in Canada and Thailand. It details critical aspects such as payroll cycles, minimum wages, taxation, and employer costs, which are essential for maintaining compliance and ensuring competitive employee benefits.

Considerations of paying two countries’ employees in Thailand

Compliance with Local Laws:

For Canadian firms in Thailand, it’s vital to comply with local wage laws, which mandate a minimum daily pay ranging from 328 to 354 Baht, depending on the province. Overtime requires careful calculation, with employees entitled to 1.5 times their regular rate, or double on holidays—for instance, from 100 to 150 Baht, or 200 Baht, respectively. Employers also need to contribute 5% towards social security, capped at 750 Baht monthly, and provident fund contributions vary between 2% and 15%, up to 500,000 Baht yearly.

Tax implications for both local and expatriate employees also need careful management. Expatriates, for instance, are considered tax residents if they spend more than 180 days in Thailand in a calendar year and are taxed on all income from Thai sources, and potentially on foreign income that is remitted into Thailand during the same year. Understanding these rules helps in planning and managing the payroll to ensure compliance and to optimize tax liabilities for all parties involved.

Currency Conversion:

Managing currency conversion is a critical aspect for Canadian companies paying employees in Thailand due to the fluctuations in exchange rates between the Canadian Dollar (CAD) and the Thai Baht (THB). For instance, if the exchange rate changes from 1 CAD being equivalent to 25 THB to 1 CAD equaling 23 THB, the impact on payroll can be significant. This scenario might mean that a salary of 2,000 CAD, initially worth 50,000 THB, would drop to 46,000 THB, affecting employee income stability.

To navigate this, companies must decide whether to pay salaries in CAD or THB. Paying in THB can safeguard local employees from exchange rate volatility, ensuring consistent purchasing power. For Canadian expatriates, companies might opt to maintain CAD payments, potentially coupled with an exchange rate adjustment clause in their employment contract. This clause would compensate for any adverse shifts in currency value, thus providing a fair and predictable pay. Additionally, using financial instruments like forward contracts can help lock in exchange rates, further stabilizing payroll costs against currency market fluctuations.

Cultural Sensitivities:

Cultural sensitivities play a crucial role in the success of Canadian companies operating in Thailand, especially when it comes to compensation, benefits, and the overall work environment. For example, Thailand celebrates numerous public holidays, including Songkran, the Thai New Year, which typically occurs in April. During Songkran, it is customary for businesses to close for several days, allowing employees to travel and spend time with family. A Canadian company must recognize and respect these cultural norms by incorporating them into their holiday schedules to ensure employee satisfaction and morale.

Moreover, traditional Thai work norms emphasize respect for hierarchy and may require a different communication approach compared to Western norms. It’s important for Canadian managers to understand these dynamics to foster a harmonious workplace. For instance, publicly criticizing an employee can be particularly face-losing in Thai culture, so providing feedback in a more private and constructive manner is essential.

Hence, benefits that align with local customs, such as providing travel allowances during major festivals or bonuses at the end of the Buddhist Lent, can significantly enhance employee loyalty and demonstrate cultural understanding. By addressing these cultural aspects thoughtfully, Canadian companies can create a supportive and inclusive work environment that respects local customs and enhances productivity.

Banking and Financial Services:

Banking and financial services are critical for Canadian companies operating in Thailand, particularly when it comes to facilitating efficient international transactions. This is vital for expatriate employees who often need to transfer funds between Canada and Thailand. For example, an expatriate might need to send 30% of their salary back to Canada to cover ongoing expenses such as mortgage payments or savings. With the average expatriate salary possibly around $5,000 USD, this means around $1,500 USD needs to be transferred monthly.

To address these needs, it is essential for companies to ensure that their banking partners offer services that can handle these international transfers with low fees and favorable exchange rates. Many banks provide specific accounts tailored for expatriates which feature benefits like multi-currency management and lower transaction costs. For instance, a bank might offer an account that reduces wire transfer fees by 50% for accounts maintaining a minimum balance of $3,000 USD or more.

Furthermore, providing access to financial advisory services can help employees better manage their finances across borders. This support is crucial for navigating the complexities of tax obligations and exchange rate fluctuations, ensuring that expatriates can maximize their earnings while working abroad. By partnering with reliable financial institutions, companies can greatly assist their employees in managing their financial commitments smoothly and efficiently.

Employee Benefits and Perks:

Employee benefits and perks are pivotal in attracting and retaining talent, especially for Canadian companies operating in Thailand. It’s essential that both Canadian and Thai employees clearly understand how their salaries and benefits are structured. For instance, a company might offer a comprehensive health insurance plan that covers not only basic medical care but also includes specialized services like dental and mental health, which are often valued by expatriates. This might involve a monthly premium cost to the employer of around $100 USD per employee.

In addition to health coverage, housing allowances are another critical benefit, particularly for expatriate staff who might not be familiar with the local housing market. For example, a typical housing allowance might range from $500 to $1,500 USD per month, depending on the city and the type of accommodation.

Transportation benefits can also be tailored to local practices. In Thailand, where traffic can be a significant issue, companies might offer a transportation allowance of $100 USD per month or provide a company shuttle service to and from work. This not only eases the commute for employees but also enhances job satisfaction and punctuality.

By aligning these benefits with local practices and expectations, and clearly communicating their value, companies can ensure a motivated and committed workforce. This approach acknowledges the diverse needs of their workforce and helps in building a supportive and inclusive company culture.

Navigating the intricacies of international employment requires a delicate balance of legal compliance, cultural intelligence, financial savvy, and strategic benefits administration. As companies strive to provide equitable compensation and benefits, they must also engage with local customs and regulatory frameworks that govern employment in both Canada and Thailand. This guide underscores the importance of adaptability and informed management in building a productive, satisfied workforce abroad. By integrating these key elements into their operational blueprint, businesses can foster a supportive environment that values both local and expatriate employees, driving success across borders.

Why Gonex?

Gonex stands at the forefront of global HR services, with established 10+ legal entities and operations across numerous countries. Our strength lies in forging in-depth relationships with local partners, ensuring clients receive top-notch services in their international ventures. Our Overseas Employment Management Delivery team, composed of seasoned HR professionals, brings years of expertise to the table, steering clients clear of pitfalls and guiding them to their goals with ease. We specialize in mastering complex employment regulations, managing seamless payroll systems, and ensuring strict compliance. Leveraging AI-driven solutions, Gonex not only simplifies international payments but also minimizes risks and secures global compliance. Embrace the convenience of unified payments, the thoroughness of our onboarding process, and the precision of our offboarding procedures. For companies looking to expand globally, Gonex EOR Services offers a sustainable, efficient path to success.

GONEX One-Stop Solution: Your strategic partner

In navigating these challenges, GONEX offers comprehensive solutions tailored to the needs of Canadian companies expanding into Thailand:

Compliance and Legal Adherence: GONEX’s Employer of Record (EOR) service ensures legal compliance in employing local staff.

Cross-Border Payroll and Tax Management: Streamlined payroll services simplify cross-border management.

Flexible Employment Solutions: Adaptable employment services cater to changing business needs.

International Talent Dispatch: Support services facilitate the dispatch of key talent to Thailand.

Digital HR Management Platform: Technology-driven solutions enhance management efficiency and cultural integration.

It is thrilled to share how our innovative payroll system seamlessly integrates the diverse regulations of Canada and Thailand, ensuring full compliance and efficiency. Understanding the complexities of cross-border payroll management is critical, and at Gonex, we’ve developed a solution that effortlessly handles varying tax rates, social security benefits, and other statutory deductions pertinent to each country.

Our system is designed to timely update and apply the specific requirements for each location, reducing the risk of errors and the burden on your HR department. For instance, it meticulously calculates the appropriate deductions and contributions based on the latest Canadian and Thai laws—whether it’s the differing percentage rates for social security in both countries and accommodating the distinct tax brackets.

Moreover, our platform offers real-time analytics and reporting features, allowing businesses to gain insights into their payroll operations and make data-driven decisions. This level of detail and customization not only simplifies payroll processing but also enhances transparency and employee trust.

Choosing Gonex means partnering with a provider that understands the nuances of international payroll management, ensuring that your company stays compliant while optimizing operational efficiency. Join us in revolutionizing how businesses manage their global payroll needs.

Let Gonex assist you and your company with handling such complex overseas hiring processes! To access more information on corporate international expansion cases, global employment guidelines, worldwide compensation management, regulations for various regional countries, and factory establishment manuals in different nations, you are welcome to visit the GONEX official website at www.letsgonex.com to download these resources or view our company’s business introduction in PDF format (https://letsgonex.com/in.pdf).